Ten Suggestions For Better Understanding The Market And Strategies To Use When Trading Online For Forex

Trading Forex can be a challenge If you have the right knowledge of markets and a strategy, you can take control of risks and improve the chances of success. These are the top 10 market-related knowledge and strategies you should consider when trading Forex online: 1.

Understanding Economic Indicators

In Forex economic indicators (such as the growth rate of GDP and employment reports) are vital because they show the state of a country's economy. Strong employment data coming from the U.S., for example, tends to boost the USD. Make sure you are familiar with the calendar of economic events to keep up-to-date with important announcements that may impact currencies.

2. Concentrate on Risk management

Start implementing risk management strategies at the very beginning. Establish take-profit and stop-loss limits to safeguard your investment and prevent excessive losses. Many traders suggest that you only risk just a small percentage of your account per transaction (e.g. 1 to 2%)

3. Use Leverage Cautiously

It is important to use leverage in a responsible manner. It's recommended to start with a lower leverage level until you are aware of how leverage affects your investment. In excess, leverage can cause massive losses.

4. Trade Plan

A solid trading plan will help you to stay disciplined. Define your goals for trading including the entry and departure points, and your level of risk. It is important to decide on the strategies you will employed, and the decision of whether you want to utilize the fundamental or technical approach or both.

5. Learn the basics of technical analysis

Analysis of the technical aspects is essential for Forex trading. Familiarize you with trendlines, support and level, moving averages, and candlestick pattern. These tools can help you identify trade opportunities and manage your entry/exit points.

6. Global News Updated Stay informed

Markets for currencies are influenced by political events as well as trade agreements central bank policies, as well as natural disasters. A central bank's surprise cut in interest rates could cause its currency to weaken. Be aware of the latest global news will help you spot any potential shifts on the market.

7. Which currency pairs should you Choose?

Some currency pairs are suitable for people who are new to the market. They include EUR/USD (EURo Dollar), GBP/USD (GBP/USD) USD/JPY, and USD/USD. While exotic currencies can sometimes provide high returns, may also be more volatile and riskier. Understanding the characteristics of every currency pair can help you choose ones that match your style of trading and risk tolerance.

8. Demo Account - Practice First

Utilize a Demo Account in order to practice strategies, and become familiar with trading platforms before you dive into live trading. This helps you build confidence, practice your strategy and avoid making mistakes in a non-risky environment.

9. Keep track of interest rates, Central Bank Policies

Central banks influence the value of currency by influencing interest rates, monetary policy, as well as other variables. Higher interest rates could boost foreign investment in a currency and thus strengthen it, while rates that are lower can decrease the value of a currency. The Federal Reserve, European Central Bank and other central banks take decisions that have a huge impact on the currency's movements.

10. Keep an Journal of Your Trades

A detailed trading log can improve discipline and help to highlight your strength and weaknesses. Keep track of the entry and exit points of each trade, and the motive and result. Examining this information regularly will reveal patterns in your trading behavior and aid in adjusting your strategy over time.

Forex trading is a complicated business that requires an in-depth knowledge of the market as well as strategic planning. Keep yourself informed, control your risk, and adapt strategies as the market changes. Have a look at the recommended https://th.roboforex.com/ for site info including fbs review, broker cfd, fx trading forex, forex broker, forex trading trading, forex trading platform, good forex trading platforms, best currency brokers, forex trading trading, forex exchange platform and more.

Ten Tips For A Successful Forex Trader When Using Fundamental And Technical Analysis

Fundamental and technical analysis are crucial to Forex trading. Learning both of them can enhance your ability to make strategic and informed choices. Here are ten top tips on how to use the fundamental and technical aspects of analysis when it comes to trading online Forex trading.

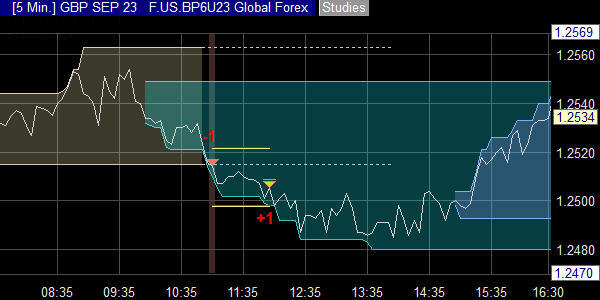

1. Find the key Support and Resistance levels

The levels of support and resistance are price zones where currencies often stop or reverse. These levels are psychological obstacles. They are thus crucial to consider when planning entry and outs. To identify the zones where a price could change or even break, it is important to find these areas.

2. Make use of multiple timeframes for Wider Perspective

Analyzing charts with various timeframes, like daily, 4 hour and 1 hour gives insight into the bigger picture as well as the short-term trends. Higher timeframes show the overall trend, whereas lower timeframes highlight specific points of entry and timing.

3. Master Key Technical Indicators

Moving averages are a crucial indicator that you can use in trading Forex. They comprise the Relative Strength Index, Moving Average Convergence Divergence and Moving Average Convergence Divergence. You can enhance your understanding by learning the way each indicator works and then combining them.

4. Candlestick patterns are crucial to take note of

Candlestick patterns, such as doji Hammer, and engulfing patterns frequently indicate potential reversals or continuations. It is possible to identify price shifts by becoming acquainted of these patterns. Combining candlesticks with other tools like support and resistance can help you improve your trading timing.

5. Look for trends that may provide directional indications

Use moving averages and trendlines to identify uptrends or downtrends. Forex traders are often enticed to invest in the direction in which the trend is moving. This method yields consistent results. If you're not an expert, avoid trading against the trend.

Fundamental Analysis Tips

6. Understand Central Bank policies and interest Rates

Central banks like the Federal Reserve Bank and the European Central Bank are in charge of interest rates. These rates directly affect the value of currencies. Higher interest rates tend to strengthen currencies, however, lower rates can weaken it. Be on the lookout for central bank statements, which could trigger market volatility.

7. Follow the Economic Indicators and Reports

Important economic indicators such as GDP (gross domestic product) and the rate of unemployment, inflation and consumer trust, could provide an insight into the health of a particular country and influence the value of its currency. Stay informed of the most recent economic news and evaluate how they impact your currency pairs.

8. Geopolitical Events and News - Study

The market for currency is susceptible to being negatively affected by events like elections or trade talks. Stay updated on global news, especially regarding major economies like the U.S., Eurozone, and China. Geopolitical volatility can be caused by sudden changes in geopolitical power.

Combining Technical and Financial Analysis

9. Aligning the technical signals to fundamental Events

Combining technical and fundamental analysis improves decision-making. In the event of an economic report that is expected to be positive and a technical analysis that shows a strong uptrend both can be combined to provide the strength of the buying signal. Combining both strategies can reduce the uncertainty and increasing the chances of getting it right.

10. The risk of trading events can be a source of opportunities

Price movements can be accelerated through high-impact news events such as Federal Reserve meetings, or announcements of employment figures that are not farm-related (NFP). Many traders avoid these times due to unpredictability, but when you're an experienced trader using analytical techniques around these events to profit from price swings. Take care and make sure you use strict limit on stop-loss. Be ready to be flexible and adapt quickly.

Forex traders can get an knowledge of market trends by using fundamental and technical analysis. By mastering these strategies traders will be able to navigate the foreign exchange markets more effectively, make better strategic choices, as well as improve overall performance. See the best https://th.roboforex.com/forex-trading/assets/other-assets/ for blog info including trader fx, platform for trading forex, currency trading platforms, forex trading forex trading, platform for trading forex, forex trading strategies, platform for trading forex, forex trading brokers, trading foreign exchange, forex demo account and more.

Top 10 Trading Platform And Technology Strategies For Those Who Are Considering Trading Forex Online

1. Choosing the appropriate trading platform and gaining an understanding of the technology used is essential in Forex trading. Here are the top 10 tips for using technology to enhance trading and navigate trading platforms.

Select a platform that is user-friendly

Opt for a user-friendly platform with simple navigation. You must be able to access charts quickly as well as manage your positions and execute orders without confusion. MetaTrader 4 (MT4) and MetaTrader 5 are popular platforms due to their flexible and user-friendly interface.

2. Ensure Strong Internet Connectivity

Forex trading depends on dependable and fast Internet access. A weak or unstable connection could result in delayed execution of orders or missed opportunities as well as slippage. If you are experiencing frequent connectivity issues, upgrade your internet or use the Virtual Private Server.

3. Test Time for Order Execution

It is essential to ensure that orders are executed quickly particularly when day trading or doing scalping. A platform that can execute orders quickly times will reduce slippage and make sure that you can trade and exit at the price you wish to. Test the platform speed in a test account prior to deciding to decide to sign up for a real one.

4. Explore Charting and Analysis Tools

A robust platform must offer advanced charting, indicators as well as technical analysis capabilities. You should look for platforms that allow the customization of charts and access to a broad range of indicators, and the capability of performing a thorough technical analysis. It will help you make better decisions when trading.

5. Verify the capabilities of Mobile Trading.

Mobile trading applications offer a variety of options in managing trades and monitoring them on-the-go. Make sure the platform has a reliable mobile app with the essential features you need, such as charting, trade execution, and account monitoring, without compromising the ease of use.

6. Find automated trading options

Many traders depend on algorithms and automated trading in order to reduce their manual work load, increase the consistency of their work, and increase efficiency. Select a platform that supports trading bots or expert advisors if automation is your goal. MT4 as well as MT5 for instance, are compatible with a variety of trading tools that are automated.

7. Verify Security Features

Online trading is a risky business. Select a platform with encryption protocols and 2-factor authentication (copyright), or other security features that ensure your money and information are safe. Platforms without adequate security could be vulnerable to cyber-attacks.

8. Find real-time news feeds as well as data

To ensure that trading is timely for trading, real-time feeds of financial news and price alerts are crucial. A good platform integrates news feeds sourced from reliable sources and offers accurate, up to date market data. This keeps you informed about important market events that could affect the trading of your portfolio.

9. Assess Compatibility with Your Trading Style

Different platforms suit different trading styles. Platforms that provide fast execution, single-click transactions and other features that are ideal for traders who are looking to scalp are the most effective. Swing traders will prefer platforms that offer more charting, analysis as well as trading tools. Verify that the platform is compatible with your specific trading needs.

10. Test Customer Support and Platform Reliability

It is likely that dependable customer support can be very helpful, especially if your platform is struggling or you need technical assistance. By asking questions, you will be able to test the team's knowledge and the speed at which they respond. Examine the platform's uptime and stability, as crashes or frequent downtime can influence the trading experience.

When you choose the best trading platform and gaining a thorough understanding of its technical aspects You can enhance your trading and be more equipped to handle market fluctuations. Consider the safety and usability aspects, as well as the tools you need to meet your preferences in trading. Have a look at the recommended https://th.roboforex.com/clients/services/up-to-10-percents-on-account-balance/ for more examples including forex trading app, best forex broker trading platform, fx online trading, best forex trading app, best forex broker trading platform, forex trading demo account, best rated forex brokers, foreign exchange trading online, fx online trading, good forex trading platforms and more.

Comments on “Excellent Tips On Picking Forex Trading Sites”